UNDERSTANDING SCUML CERTIFICATES IN NIGERIA

The Special Control Unit against Money Laundering (SCUML) is a department within the Economic and Financial Crimes Commission (EFCC) in Nigeria. It is the regulatory body responsible for supervising, monitoring, and controlling the activities of Designated Non-Financial Institutions (DNFIs) to ensure compliance with the Money Laundering.

SCUML REQUIREMENTS:

To apply for a SCUML Certificate (whether directly or with our assistance), you will generally need the following documents and information:

✅ Complete CAC Documents:

✅ Certificate of Incorporation

✅ Status Report

✅ MEMART (Memorandum and Articles of Association) for Limited Liability Companies

✅ Constitution for NGOs, Churches, and Associations

✅ Company / Organization Name

✅ RC (Registration Certificate) / BN (Business Name) / IT (Incorporated Trustees) Number

✅ Date of Incorporation

✅ Bank Account Details (Personal Account Can be used)

✅ BVN (Bank Verification Number)

✅ Registered Address

✅ Sector / Industry of Operation

✅ Name of Director / Trustee (at least one)

✅ Director’s/Trustee’s Identification Card (at least one)

✅ Director’s/Trustee’s NIN Slip or International Passport (at least one)

✅ Active Email Address

✅ Active Phone Number

✅ FIRS TIN Printout or JTB TIN Certificate (Disregard if the CAC Certificate already has the TIN at the bottom)

✅ Professional Certificate (if applicable to your sector/industry):

✅ Engineering/Construction: COREN (Council for the Regulation of Engineering in Nigeria) Certificate

✅ Schools: TRCN (Teachers Registration Council of Nigeria) Certificate

✅ Consultancy: Relevant Professional Training/Certification

✅ Legal Firms: Call to Bar Certificate

REASONS FOR OBTAINING SCUML CERTIFICATES

Obtaining a SCUML Certificate is crucial for Designated Non-Financial Institutions (DNFIs) for several key reasons:

✅ Legal Compliance: It is a mandatory requirement by Nigerian law (Money Laundering (Prohibition) Act and Terrorism (Prevention) Act) for certain businesses to register with and obtain a certificate from SCUML. Failure to do so can result in penalties and legal repercussions.

✅ Facilitates Business Operations: Many financial institutions, government agencies, and other businesses may require proof of SCUML registration before engaging in transactions with a DNFI. Having a valid certificate ensures smooth business operations.

✅ Builds Trust and Credibility: Holding a SCUML Certificate demonstrates your organization’s commitment to complying with anti-money laundering and counter-terrorism financing regulations, enhancing trust and credibility with stakeholders.

✅ Enables Participation in Certain Transactions: For DNFIs involved in activities that are susceptible to money laundering or terrorism financing, the SCUML Certificate is often a prerequisite for participating in those activities legally.

WHAT YOU GET

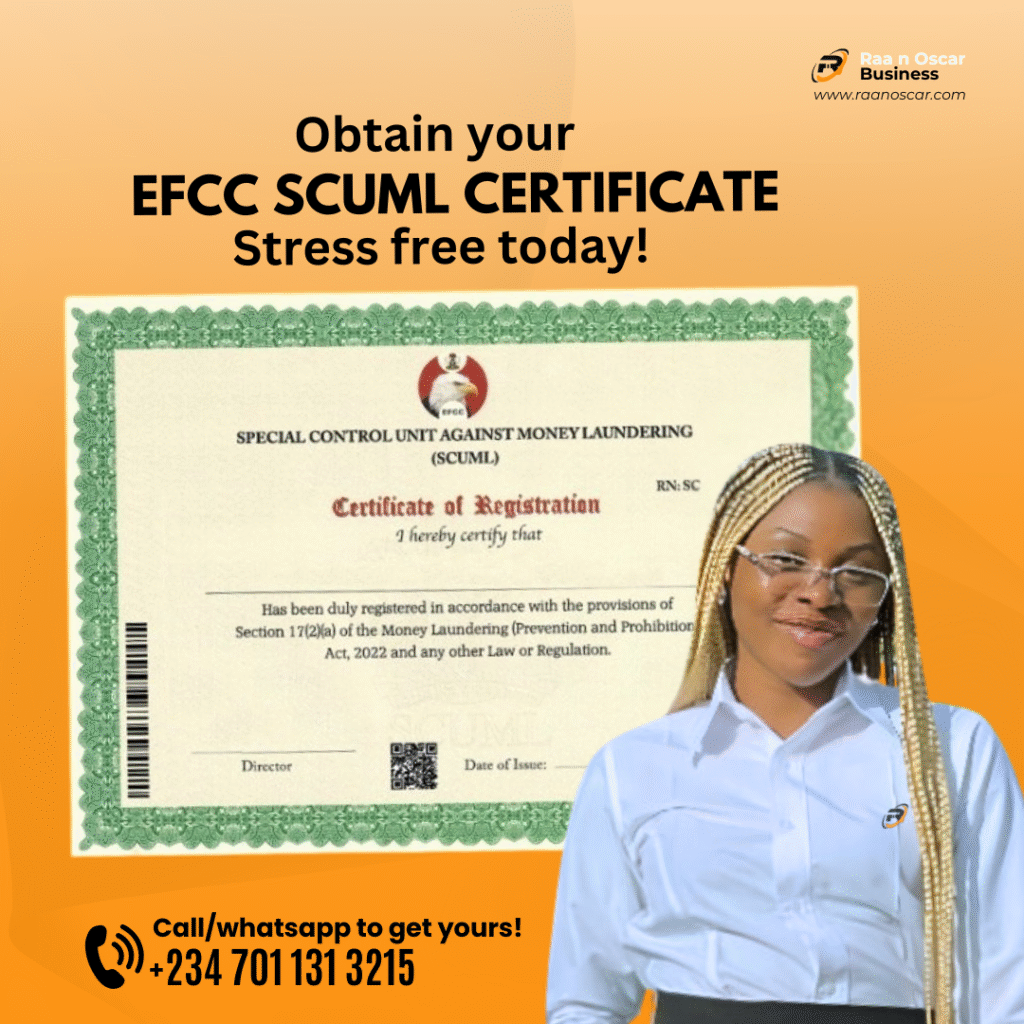

Upon successful application (whether directly or with our assistance), the EFCC will issue a digital SCUML Certificate in PDF format, which will be sent to your provided email address and WhatsApp number.

✅ Digital SCUML Certificate (PDF Soft Copy): This is the official confirmation of your organization’s registration with SCUML.

AIM AND OBJECTIVES FOR OBTAINING SCUML CERTIFICATES

Aim: To achieve legal compliance with anti-money laundering and counter-terrorism financing regulations in Nigeria for Designated Non-Financial Institutions.

Objectives:

✅ To fulfill the mandatory registration requirement set forth by the Money Laundering (Prohibition) Act and the Terrorism (Prevention) Act.

✅ To obtain the official SCUML Certificate as evidence of registration.

✅ To facilitate smooth business operations by meeting the compliance requirements of financial institutions and other stakeholders.

✅ To demonstrate a commitment to preventing financial crime and promoting transparency.

FAQS

What is a SCUML Certificate?

✅ A SCUML Certificate is an official document issued by the Special Control Unit against Money Laundering (SCUML), a department of the EFCC, to Designated Non-Financial Institutions (DNFIs) upon successful registration, signifying their compliance with anti-money laundering and counter-terrorism financing regulations.

Who needs a SCUML Certificate?

✅ Designated Non-Financial Institutions (DNFIs) as defined by the Money Laundering (Prohibition) Act are required to obtain a SCUML Certificate. This includes businesses such as real estate agents, car dealers, hotels, casinos, bureau de change operators, jewelry dealers, and many others.

✅ SCUML Certificates typically have an expiration date and need to be renewed periodically. It’s important to stay informed about the validity of your certificate and the renewal process through the official SCUML channels.

What happens if a DNFI doesn’t have a SCUML Certificate?

✅ Failure to register with SCUML and obtain a certificate when required by law can lead to penalties, sanctions, and potential legal consequences as outlined in the Money Laundering (Prohibition) Act and related regulations.

COSTS:

✅Normal Processing: ₦-

Timeframe: 10 – 30 working days

✅ Express Processing: ₦-

Timeframe: 3 – 4 working days

For a detailed breakdown of our service charges, please visit our official WhatsApp Channel:

https://whatsapp.com/channel/0029Vb3313w2JSDoq2Z

TIMELINE:

The timeframe for obtaining your SCUML Certificate depends on the processing option chosen (if you opt for our assistance):

Normal Processing: 10 – 30 working days

Express Processing: 3 – 4 working days

NOTE:

Please note that these timelines are for our assisted application service. The processing time for direct applications through the official SCUML website may vary.

For more information, please contact us on:

WhatsApp: +2349025874439